Frequently Asked Questions

Wire Transfer & Stock Gift Instructions

Please find our instructions for Wire Transfers and Stock Gifts here

How Endowment Works

Establishing New Funds

Should a new fund be set up this fund with the Foundation or with The Regents?

The general guidelines are:

Recommend set up as a Regents gift fund:

If the donation is (1) a one time gift and the department expects to spend the entire amount within the current fiscal year, (2) a fellowship with a named Fellow, (3) a gift for a Pooled Income Fund, (4) Real Estate NOT TO BE SOLD, (5) gift-in-kind to be added to departmental inventory and not sold, (6) small memorial/honorarium gifts, we recommend you set the fund up with The Regents directly. A new Regents' gift fund number will be assigned and the funds can be expended for the purpose designated by the donor. All gifts require a gift letter, solicitation, proposal, and any other related correspondence that document a donor's intent be provided to Gift Services.

Recommend set up as a Foundation gift fund:

If a department has (1) multiple or regularly recurring gifts (pledges) for the same purpose, (2) gifts of real estate for immediate sale and highly marketable or with special circumstances, (3) art gifts, (4) gifts of stock, (5) Endowed gifts, (6) most gifts for capital projects, (7) annual benefits/solicitations/fundraiser events (gifts with quid pro quo), (8) Planned/Deferred Gifts (Lead Trusts, Life Estates, Gift Annuities & Charitable Remainder Trusts), the fund should be established with the Foundation. All gifts require a gift letter, solicitation, proposal, and any other related correspondence that document a donor's intent be provided to Gift Services.

Gifts of real estate, art or stock:

When gifts of this nature are given, there are various appraisals, valuations and other items involved prior to gift acceptance. The Foundation office is local and has expertise in processing gifts of this nature, thereby ensuring that the monies are made available to the department as quickly and efficiently as possible.

Regardless if the gift is to the Foundation or to The Regents, each gift is key entered by the gift services staff and a gift receipt and a thank you note is generated for each gift.

If you need assistance, please submit a request on the UC San Diego Service and Support portal; About: Gift Funds, Related to: Gift Fund Inquiries; More Specifically: Event Approval, Gift Agreement Review or Gift Fund Questions, as applicable.

How do I set up a new fund?

To set up a new fund, please go to our forms page, complete a New Fund Request Form, and submit it through the UC San Diego Service and Support portal; About: Gift Funds, Related to: Gift Fund Setup & Transfer; More Specifically: New Gift Fund.

If you need assistance, please contact the Gift Services office through the support portal, selecting About: Gift Funds, Related to: Gift Fund Inquiries; More Specifically: Gift Fund Questions.

What do the letters mean in the fund number?

Gift funds are alphanumeric. If the fund starts with A through L, it is a UC San Diego Foundation fund. If the fund starts with M through X it is a UC Regents fund. Each letter represents the restriction level of the fund.

A current fund is a fund in which all gifts to the fund can be spent for the purpose designated by the donor.

An endowment fund is a fund in which the original amount of the gift (endowment principal) is invested in perpetuity for appreciation. Only the expendable income (payout) allocated to the endowment expendable fund may be spent on the purpose designated by the donor.

Foundation |

Regents |

Description |

| Current-Use Funds | ||

| A | M | Unrestricted |

| E | R | Restricted |

| Endowments | ||

| K | W | Endowment Principal |

| F | T | Restricted Endowment Expendable |

| B | N | Unrestricted Endowment Expendable |

| Unrestricted FFEs | ||

| C | Unrestricted FFE Principal | |

| D | P | Unrestricted FFE Expendable |

| Restricted FFEs | ||

| G | Restricted FFE Principal | |

| H | U | Restricted FFE Expendable |

| Trusts/CGAs | ||

| J | V | Trusts/CGAs for Restricted Expendable |

| L | X | Trusts/CGAs for Endowment Principal |

I want to track my gift at a more granular level. How do I set up a new project or task?

You can create a general project using PADUA once your fund has been added in Oracle. If you need assistance with using PADUA, please see this knowledgebase article.

My fund has been set up, but how do I create a link for online gifts?

To create a link to a single fund on the online giving page please use the fund link generator. The fund link generator is a quick and easy tool that allows you to get direct links to any funds you need.

Use of Gift Funds

How do I spend the money in an established fund?

The Foundation and Campus have both transitioned to Oracle Financial Cloud (OFC) with separate ledgers. The fund number is the same on both ledgers, so there is no need to set up a transfer fund. Foundation gifts will still need to be transferred to campus for expenditure.

- Foundation expendable gift and endowment payout balances will be transferred to the Campus ledger monthly, one month in arrears. For example, a gift or payout received in March will be reflected on the Campus ledger in April.

- Any gift for research requiring clearance through the COI office for Economic Interest will be held until the transfer after clearance has been received.

- Delays in the transfer of endowment payout will occur during the first quarter of the fiscal year due to fiscal year end dependencies.

- Regents expendable gifts will be recorded during the month end close process, around the 5th business day of the following month.

- Any gift for research requiring clearance through the COI office for Economic Interest will be held until the transfer after clearance has been received.

- Regents endowment payout will be recorded on the campus ledger each fall for the prior fiscal year.

- Gift revenue and endowment payout will be recorded to a specified chart string, which only needs to be provided once. If a form is not received, gift revenue and endowment payout will be recorded to the Owning FinU per STAR and Project 0000000.

- Once gift revenue is recorded if you need to allocate the money to another project or financial unit, please complete a resource transfer. For information about resource transfers please see this knowledgebase article.

- If you need a new project or task for your request, please create one using PADUA and review this knowledge base article for instructions. Project and task management is not handled by our office.

- Please go to our forms page and select the Gift Fund Chart String form. This form allows you to establish the chart string referenced above.

- Endowed chairs: DO NOT COMPLETE THIS FORM. The payout for endowed chairs will be transferred to a central VC chart string. Someone in the VC’s business office will complete a resource transfer to move the payout into the chairholder’s project once the requirements of Academic Policy PPM 230-8 Section II D have been met.

- When you’ve completed the form, attach it to a case in the UC San Diego Services & Support Portal, About: Gift Funds; Related to: Gift Fund Setup & Transfer; More Specifically: Gift Fund Chart String. The ticket will be closed once the chart string has been added to the fund in Oracle.

- If you have questions, use About: Gift Funds, Related to: Gift Fund Inquiries; More Specifically: Gift Fund Questions.

Why do I have to transfer to the same fund on the Campus ledger for Foundation transfers? Why can’t I just transfer the money to an existing Campus fund? Why can't I journal across funds?

Fund accounting rules do not permit the commingling of different "types" of monies. Gifts made directly to a Regents' fund are considered to be a different "type" of money from funds that are transferred from a Foundation fund because of the difference in the source. Similarly, on the Campus, General Funds cannot be commingled with Opportunity Funds. The only way you can use the money held in a Foundation fund is to transfer the balance to the Campus ledger to the related gift fund. Only the Foundation can deposit money into this fund. However, certain expenses incurred in other Regents' funds can be transferred to the Foundation transfer fund (via cost transfer). Once the balance has been transferred from the Foundation to Campus, you can use the same processes and forms to expend it as with any other Regents fund, except that it must be spent in accordance with the donor's wishes.

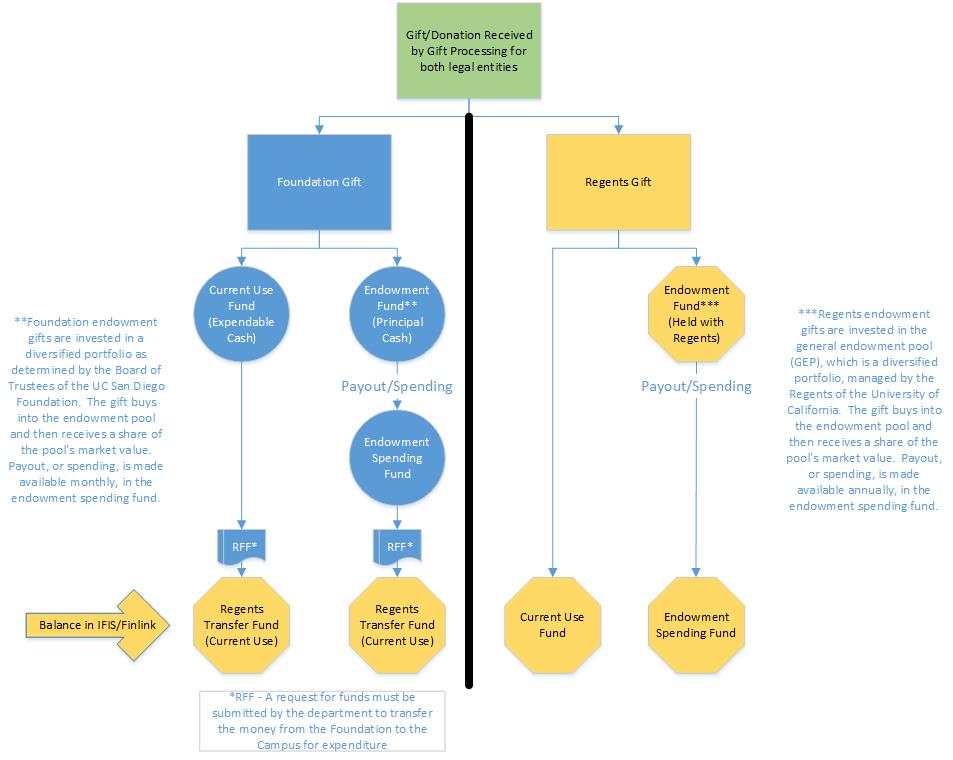

An analogy is to think of the Foundation fund as an account at bank A and the Regents' transfer fund as an account at bank B. The two accounts are linked together and when you need to spend money from your account at bank B (expenditures from the Regents' fund), you will need to transfer funds from your account at bank A to your account at bank B. The following is an illustration of the flow of gift money.

Will I be getting a general ledger from the Foundation?

You can obtain gift fund balance information from two places:

-

-

The STAR Dashboard contains endowment expendable fund number, donor lists, gift documentation, endowment payout projection letters, market value, and balances for gift funds at the fund level. The campus expendable in STAR reflects the balance of the entire fund, regardless of project or financial unit. If there is a discrepancy, please run an oracle balance report on the fund only to see where other balances may exist.

-

-

FDN-DSH Gift Fund Panorama at bah.ucsd.edu

- Foundation Fund Details: Provides information from the Foundation ledger including account balances and transaction detail.

- Gift Fund Balances: Displays cash balances on both the Foundation and Campus ledgers down to the FinU and Project where a balance resides. To view this report properly, you must have the GL Inquiry Role for the Foundation ledger. KB0032240

- GL (UCSD) Project Balances: Provide a total for Resources Available, with consideration of the displayed General Ledger resource and expense totals and inception-to-date Capital Assets expenditures.

- General Ledger (UCSD) Transaction Details: Provide FinU/Fund/Project/Account transaction data that hits the General Ledger and all Subledgers (PPM, Payables, Receivables, Cash Management) for the selected accounting period.

- Project COA Lookup: Provides the ability to quickly locate the new Chart of Account (COA) data for your Projects.

- Non-Sponsored Project Task DFFs: Delivers the fund, function, location, and activity defined for given tasks on a general project for the purpose of driving accounting for costs and revenue within the PPM module.

- Please complete the Oracle BI - Gift Fund Panorama training lesson for more detailed information about each report.

The month is closed, and the market values are available, by the 14th business day of the following month (except for June and December). June's books are typically closed in mid-August due to the timing of receipt of our investment statements. December's books are typically closed in late January or early February due to the additional time needed to process increased giving due to the end of calendar year giving for donor's tax purposes.

Who can access the STAR Dashboard?

Access to the STAR Dashboard is available to all Advancement staff and non-Advancement staff with Oracle access. Your user name and password are the same as your AD network login. Internet Explorer is the preferred browser.

I'm having trouble with the STAR Dashboard. Who do I contact?

Please contact ACT at ACT-EA@UCSD.EDU if you're having any trouble with the dashboard. Please include screenshots, time of day, the browser you're using, and your phone #.

I need to know what my balance is right now. How can I get that?

We would be happy to provide an estimate of the fund balance at any time. Please submit a case in the UC San Diego Services & Support Portal (About: Gift Funds, Related to: Gift Fund Inquiries; More Specifically: Gift Fund Questions) and we will provide the balance.

I’m new to the University and I need to be able to access these funds. How do I go about doing that?

Please submit a case in the UC San Diego Services & Support Portal (About: Gift Funds; Related to: Gift Fund Setup & Transfer; More Specifically: PI or BO Changes).

There was a pledge made to my fund. Why can`t I see it on my Foundation ledger?

Only pledges greater than or equal to $10,000 are recorded into the ledger as a receivable. If a pledge is less than $10,000, contributions are recorded when payments are made.

Current vs. Endowment Funds

What is the difference between a current fund and an endowment fund?

A current fund is a fund in which all gifts to the fund can be spent for the purpose designated by the donor.

An endowment fund is a fund in which the original amount of the gift (endowment principal) is invested in perpetuity for appreciation in accordance with the Foundation's Endowment Investment Policy. Only the expendable income allocated to the endowment fund as set by the spending policy may be spent on the purpose designated by the donor. Due to the nature of how endowments are invested (primarily in the stock market), they may earn a total annual return (appreciation plus yield) that is far in excess of the spending policy. Total return earned in excess of allocated spending is retained in the investment pool to provide for growth in the principal. This, in turn, increases the market value of the pool, and thus the five year average, which then increases expendable income allocations over the long term. This methodology preserves and enhances the real value of the endowment principal and protects the expendable income allocations against erosion from inflation.

Is there a way to find out how much my endowment fund will be allocated for next fiscal year?

Yes, each year in late May or early June, a letter is posted in STAR on each endowment fund with the following fiscal year's spending allocation projection.

What is the difference between an endowment fund book value versus market value?

The endowment "book value" is the original gifts or "principal" to the fund plus any additions of unspent income requested by the department in accordance with the gift agreement. The endowment "market value" is the current market value of the investment of the endowment principal and represents the appreciation or growth of the principal.

Fees & Other Information

Does the Foundation pay interest on the expendable gifts?

No, UC San Diego Policies and Procedures Manual (PPM) in section 410-10 requires that investment returns earned on expendable gift and private grant funds be placed in an account under the control of the Chancellor.

Why is my fund charged fees?

All processing fees charged by 3rd party vendors are passed through to the fund receiving the gift. The most common fee is for credit card gifts where the bank charges approximately 2%. Other less common tender types are charged fees at different rates as determined by the 3rd party processor.

To make a credit card gift on-line, please go to our secure on-line giving web site.

Does the Foundation charge a fee on gifts received?

Effective July 1, 2015, UC San Diego will no longer assess a gift fee, whether current use or endowed, on charitable gifts made to either the UC San Diego Foundation or to the UC Regents. In addition, the fee will not be collected on payments received after July 1, 2015 for pledges made on or before June 30, 2015. For any agreements in place related to gift fee collections that were to occur over time or that were to be split (for example, fee collections from endowment payout and/or from campus unit funds), the fee will not be collected. This demonstrates the Chancellor's extraordinary personal and institutional commitment to philanthropy and its importance and impact to the campus.

- UC San Diego Faculty or Staff: Submit a Services and Support Ticket including the business purpose of your request to About: Gift Funds, Related to: Gift Fund Inquiries; More Specifically: Gift Fund Questions.

- External: Email foundationboard@ucsd.edu

Non Discrimination Statement

In accordance with applicable Federal and State law and University policy, the University of California does not discriminate, or grant preferences, on the basis of race, color, national origin, religion, sex, disability, and/or other protected categories.More information about Proposition 209 can be found here.

More information about the University of California Anti-Discrimination Policy can be found here.